A Tax-Free Gift with Your IRA Rollover

Are your required minimum IRA withdrawals greater than you need, or care to receive? Would you like to reduce the taxable income from your IRA? The IRA charitable rollover (also known as a Qualified Charitable Distribution ...

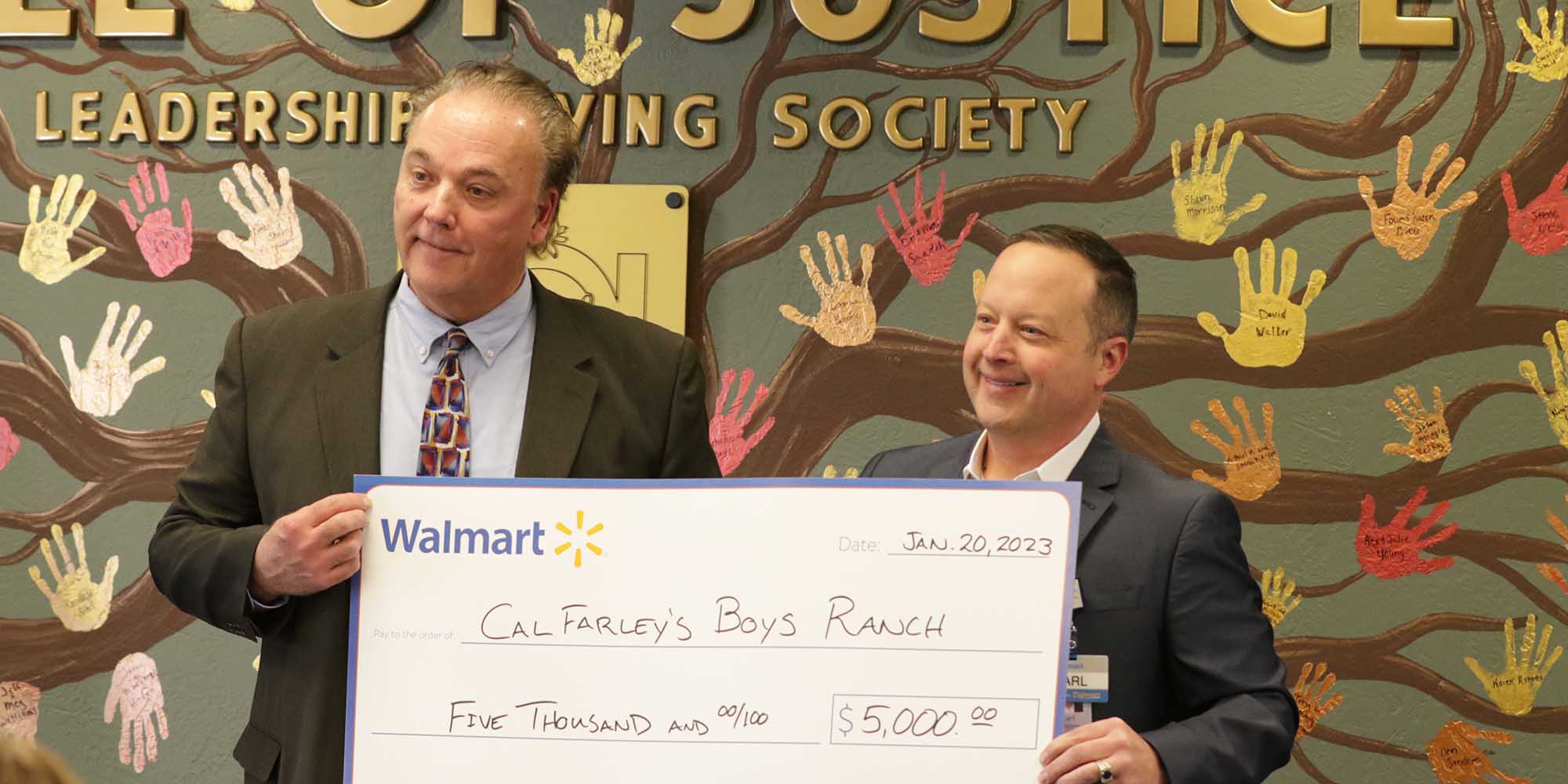

Charlotte Breeding: Giving children a better life

“I went to the Boys Ranch Rodeo last year and enjoyed it so much,” she explained. “Those little children, clear up to the older children, even the ones who had graduated, came and ate lunch with ...

Planning Your Charitable Legacy

Charitable gifts included as part of your long-range estate and financial plans can offer a wonderful way to provide lasting support to Cal Farley’s and other charities you care about. You can make a “gift of ...

Make a Difference Today

Those with an IRA who have reached age 70½ are familiar with the required minimum distributions (RMDs) — the amount that must be withdrawn annually based on the owner’s age and the account value as of ...

Smart Giving This Fall

Although nearly half of Americans hold securities like stocks, bonds or mutual fund shares, many do not realize they can give those securities directly to a charitable organization instead of giving cash. Using securities can be ...